Millionaires' Club: The Whisky List

DI's annual league of brands returns. Here's the list of the world's best-selling whisky brands in 2015, taking you through the Indian, Scotch, North American, Irish and Japanese million-case brands.

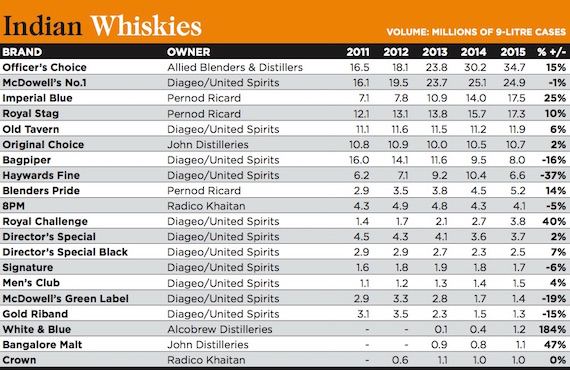

Indian whisky is a mixed ride of thrills and ills. Each year we check in on the category there are brands that have rapidly climbed the market with seemingly no end in sight, and there are those experiencing that sick-to-their-stomach feeling as the big dip bites. As ever, Indian whisky is a rollercoaster.

This year 11 of 19 Indian whisky million-case brands are in growth. But first to the category leader, Officer’s Choice. The Allied Blenders brand has carved another 4.3m cases out of the market this year, taking it’s output to 34.7m cases.

The route to success in Indian whisky is over- delivering within a brand’s segment. Officer’s Choice has performed that trick with aplomb over recent years. Its standard core brand brings in the numbers but success has also been found with its ‘semi-premium’ Blue edition and ‘semi-premium-plus’ Black variant. Each looks to capture a different piece of the Indian whisky jigsaw.

McDowell’s No.1 looks a long way back in second now. In 2013 it was just 0.1m cases behind Officer’s Choice, now it is almost 10m cases adrift. Still, maintaining 25m cases in a market of low consumer loyalty is no easy task. Diageo’s top selling whisky remains a good distance from Pernod Ricard’s leading duo, Imperial Blue and Royal Stag, which are now around the 17m case mark. Both brands are growing nicely with 25% and 10% hikes each last year, but no brand in India can fall complacent.

Diageo’s Bagpiper is testament to how things can rapidly deteriorate. The brand sells just half of the 16m cases it did in 2011, suffering more double-digit decline in 2015. In theory the consumer pool in India should be increasing as society gets richer, liberalism pervades and new LDA consumers join the category, but for now volume sales of whisky are flat at about 171m cases.

Most of the ups and downs in the Indian whisky category are from hungry, agile brands cannibalising sales. But green grass may grow again – Euromonitor International forecasts a 20% increase in volumes by 2020.

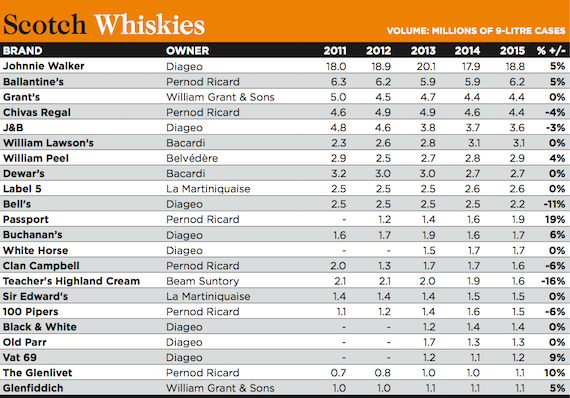

The 2015 results don’t overwhelmingly bear the trend out, but there are underlying moves in scotch towards lower-priced brands. Diageo has spoken of its strategy for ‘mainstream brands’, with more effort and marketing now to be directed towards the cheaper journeymen of its portfolio. Pernod Ricard, meanwhile, has refocused its sights on occupying the ‘centre ground’.

This is a shift from the dogmatic premiumisation drive of years past and is down to faltering emerging markets – essentially not everyone can afford premium products. If trends continue in many key emerging markets (Latin America: recession and political instability, Russia: currency devaluation and EU sanctions; China: government clampdown), these lean, once-neglected brands, will increasingly fill the breach that premium left behind.

According to Euromonitor Interntaional’s Jeremy Cunnington, many of the million-case brands that managed to find growth in 2015 tended to be those “focused at the lower price points such as Passport and VAT 69”.

Johnnie Walker and Balantine’s growth were both driven by “lower priced variants”, adds Cunnington. Walker, as a brand of many parts and price positions, can follow the direction of the wind, and managed growth of 5%, driven by positive trends in Latin America, Europe and Asia. But it’ll take growth of a couple of percentage points more next year to see the brand equal its 2013 peak of 20.1m cases.

One notable omission from this list is Famous Grouse. Edrington refused to provide Drinks International with sales data for the brand.

In North American whiskey, Jack Daniel’s continues to forge ahead, breaking through the 12m-case barrier with healthy 4% growth. Cunnington reports the brand has excelled domestically and in the UK, France and Poland. But the real excitement around this category is born out of the global spread of high- end brands, just short of the million- case mark, rather than the established lower-level players, such as Seagram’s Seven Crown and Canadian pair Black Velvet and Canadian Mist.

“Bulleit, Knob Creek and Woodford Reserve are growing strongly at the expense of economy brands,” says Cunnington, “while Canadian whiskey suffers from its poor man’s image and narrow geographic spread.”

Meanwhile, Irish and Japanese categories continue to succeed in convincing the developed markets there is an alternative to scotch. Jameson, now over 5m cases, has accelerated past the likes of Chivas Regal and Grant’s and is rubbing shoulders with the second tier of premium whisky players that includes Crown Royal, Ballantine’s and Jim Beam. Jameson will likely be joined in the Club next year by Tullamore Dew, which has also found success in its shadow in the US.

Unlike the smaller but more internationally famous Nikka and Suntory malts, the Japanese blends Suntory Kakubin and Black Nikka Clear are heavily dependent on their domestic market. Right now, whisky is the drink of young people so growth is on an upturn.