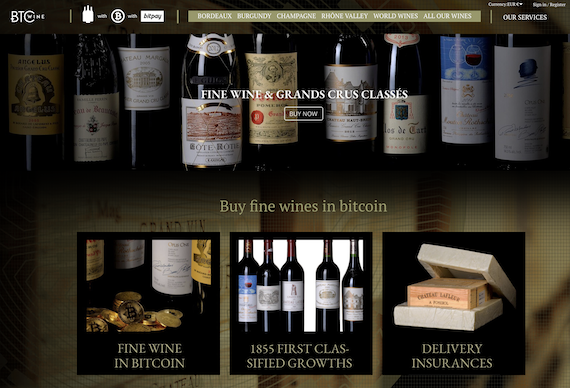

BTC Wine sees demand spike following Bitcoin bull run

A luxury online wine retailer has enjoyed a surge in demand after the value of Bitcoin increased by around 1,000% between March 2020 and January 2021.

Lasserre & Papillon, a negociant based in Bordeaux, set up BTC Wine when Bitcoin enjoyed a remarkable bull run during 2017. The world’s most popular cryptocurrency increased from $900 to an all-time high of $19,783.21 that year.

Conditions naturally became ripe for a reversal, and the Bitcoin mania subsided as its value dropped below $7,000 by March 2018. Yet the BTC Wine team was undeterred, and it continued to fine tune its offering, confident that another bull run would soon take off.

BTC Wine sells high-end wines by the case to consumers around the world, and they pay using Bitcoin, Ethereum or Bitcoin Cash. Its current bestsellers are Cheval Blanc 2015, Canon La Gaffelière 2009, Sassicaia 2014, Louis Roederer Cristal 2009, Latour 2005 and Pavie 2006.

Bitcoin was worth around $8,000 by March 2020, but it lost half of its value in a two-day plunge after the World Health Organization declared Covid-19 to be a pandemic. Yet savvy investors sensed an opportunity after it crashed below the $4,000 mark. They started snapping up BTC at discounted prices, and then a Bitcoin halving took place in May.

For the uninitiated, a halving takes place once every four years, and it cuts the reward for mining new blocks in half. That reduces the number of new Bitcoins being generated by the network, making the existing supply more value. In theory, it should push prices up if demand remains strong.

Bitcoin took off again. By mid-December, it had broken the previous all-time high set in 2017, and it went past the $40,000 mark for the first time in January 2021. Since then it has generally been hovering between $30,000 and $37,000. Many people that bought at the bottom began selling their Bitcoins and leading the high life at a time when most people are strapped for cash.

BTC Wine was therefore uniquely placed to thrive at a time when the majority of the French wine trade was in disarray.

“It’s going very well, because of the bull run,” says sales director Louis de Bonnecaze. “We have a new kind of customers. They have a lot of Bitcoin, and they want to spend it. Fine wine is a status symbol. They have bought the cars and the real estate, and then they go directly to the fine wine, so it’s a good market for us.

“The wine market is not doing very well, because we are experiencing Covid, Brexit, the tax in the U.S. For us, cryptocurrency payments has been a way to make some business in this very difficult period. The cryptosphere is a fascinating topic. For us it is above all a way to open our fine wine business to new tech wealthy customers. Blockchain technology opens new perspectives regarding traceability and logistics. We are thinking about exploring these perspectives.

“We find synergies between wine and cryptocurrency, because wine in a way is a tangible asset and Bitcoin is another asset. It was natural for us to mix the two businesses.”

BTC Wine has three different meanings. BTC is the abbreviation of Bitcoin, like USD, EUR, GBP and so on. It also means Business To Consumer, and By The Case. Many of BTC Wine’s customers are younger than your average fine wine buyer, but de Bonnecaze says the firm has received interest from a pretty broad range of clients.

“The main core of customers are in their 30s and 40s, but you have some people who are in their 60s or 70s,” he says. “Recently we had a guy whose son gave him one Bitcoin a few years ago [now worth more than $35,000] and he wanted to spend it. He didn’t know anything about it, so we helped him to spend it with his wallet.”

The team has found that sales perform well during bullish market conditions, but they decrease during bearish conditions. When asked how he thinks Bitcoin will fare in the years ahead, de Bonnecaze says: “My friends know I am dealing with Bitcoin, and they contact me to ask my predictions. I am pretty sure that Bitcoin and blockchain and the cryptocurrency market will grow in a very huge way in the long-term. But of course if you enter now, you will lose money, because I am pretty sure there will be another decrease. In the long-term I think it will be very useful.”

The current range features around 200 wines, spanning Bordeaux Grands Crus, top Burgundy wines, Rhône Valley fine wines, luxury Champagne, Super Tuscans and high-end Spanish wines. Yet the team is in the process of increasing the range to 2,000. “We are looking for the best wines in every country. We have bought the best wines from England – the most expensive sparkling wine that Chapel Down has, about £100 a bottle. We only want luxury wines. We don’t want to sell by the bottle or cheap wines. That’s not our business. “

The fine wines are packed in original wooden cases and shipped around the world, with full insurance and safety over-packaging.

It has also created a limited edition called Bitcoin la Cuvée, which is available in Margaux and Saint-Emilion Grand Cru, packed in original wooden case of six bottles numbered from 1 to 1440, with the option of purchasing in Bitcoin and other cryptocurrencies.

Accepting Bitcoin as a banking method presents challenges and opportunities for a wine merchant. The advantage of Bitcoin, Ether and Bitcoin Cash is that they are decentralized, peer-to-peer currencies. They allow direct transfers from one wallet to another, crossing international borders with ease and cutting out the need for a middleman. Banks and traditional financial institutions do not get involved, so there is no need for handling fees, conversion fees and so on. That makes it a lot cheaper to deal in crypto than in fiat currencies like euros and dollars.

It is also a lot quicker. A traditional bank transfer can take several business days to arrive, whereas Bitcoin arrives in around 15 minutes. Ether and Bitcoin Cash are even quicker, as these altcoins have shorter block times. These transactions are also very secure, as only the sender and recipient have the keys.

The main challenge is the volatile nature of cryptocurrencies like Bitcoin, Bitcoin Cash and Ether. They can lose 10% of their value in a day, but merchants can mitigate this by using a platform like BitPay.

“We use BitPay for processing payments and it’s very easy to use,” says de Bonnecaze. “I even recommend my competitors to use it. If a customer sends us 1 BTC to buy a case of Petrus, we can decide to transfer automatically 100% [to euros], or we can keep a certain amount in Bitcoin. We could take 95% in normal currency in our bank account and keep 5% in BTC to bet on the crypto market [hope that the price increases].”

Trading in Bitcoin actually helps protect an international business BTC Wine against forex fluctuations, because it arrives so quickly and can instantly be converted to euros via BitPay.

A few other merchants have followed suit and started to accept BTC, and de Bonnecaze welcomes as much competition as possible in this space. “If we have a lot of competitors it will help the market grow bigger. We would like Bitcoin to be a money, and if it is to be a money, it needs to be exchanged, which is why I am welcoming other people to do the same, even our competitors. We need all the actors in our business and other businesses to use it. We need mass adoption.

“I fully recommend it, because it will bring new customers to you. Some people are a little bit scared, because they have heard about it being money from money laundering, terrorism, the dark web and stuff like that, but I explain that the dark web was not waiting for Bitcoin to be effective, and there are a lot of money laundering transactions with dollars and other currencies, so it’s not new.”

Lasserre & Papillon is one of the younger negociants in Bordeaux, so it is happy to take risks, push boundaries and blaze trails. It hopes to see companies within the trade exploring crypto.

“We would like to pay our suppliers in Bitcoin, but we will have to wait a little bit to pay Cheval Blanc or Margaux with Bitcoin,” says de Bonnecaze.